What is zero based budget with example?

A zero-based budget is a budgeting system where you assign a specific purpose for each dollar of your income. Using this system, you would distribute every dollar to an area, such as paying rent or planning for retirement.

Zero-based budgeting (ZBB) is a budgeting approach that involves developing a new budget from scratch every time (i.e., starting from “zero”), versus starting with the previous period's budget and adjusting it as needed.

Zero-based budgeting is when your income minus your expenses equals zero. Perfect name, right? So, if you make $5,000 a month, everything you give, save or spend should add up to $5,000. Every dollar that comes in has a purpose, a job, a goal.

A zero-based budget is a framework that assigns a job to every dollar of your take-home pay. In other words, you're aiming for what you bring in and what you send out to hit zero each month.

- Auto manufacturer General Motors Co.

- Industrial firm Honeywell International Inc.

- Cosmetics business Coty Inc.

- Chocolate maker Hershey Co.

- Alcoholic-beverage company Diageo PLC.

Zero-based budgeting is a method that has you allocate all of your money to expenses for needs and wants, as well as short- and long-term savings and debt payments. The goal is that your income minus your expenditures equals zero by the end of the month.

The biggest difference between zero-based budgeting and the traditional budgeting method is that the budget for each new planning period is created from zero. This enables analytical re-planning. In most companies, each business unit creates its own budget plan based on requirements and presents to management.

Zero-based budgeting is also resource-intensive. It takes a lot more time and effort to closely review and justify every budget element rather than modify an existing budget and review only new elements. Some critics argue that the benefits of zero-based budgeting don't justify its time cost because of this.

Zero-based budgeting is an approach that starts budgeting from scratch by justifying every expense. It aims to reduce unnecessary costs by involving employees. Differences from traditional budgeting include starting from zero and decision-making focus.

In recent years, The Coca-Cola Company (KO) is facing decreased global demand for its soft drinks due to customer health concerns about the sugary drinks. It has responded to decreased demand with a variety of ways, including cost cutting measures.

What is the 60 40 budget rule?

Save 20% of your income and spend the remaining 80% on everything else. 60/40. Allocate 60% of your income for fixed expenses like your rent or mortgage and 40% for variable expenses like groceries, entertainment and travel.

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings.

What is a 'pay yourself first' budget? The "pay yourself first" method has you put a portion of your paycheck into your savings, retirement, emergency or other goal-based savings accounts before you do anything else with it. After a month or two, you likely won't even notice this sum is "gone" from your budget.

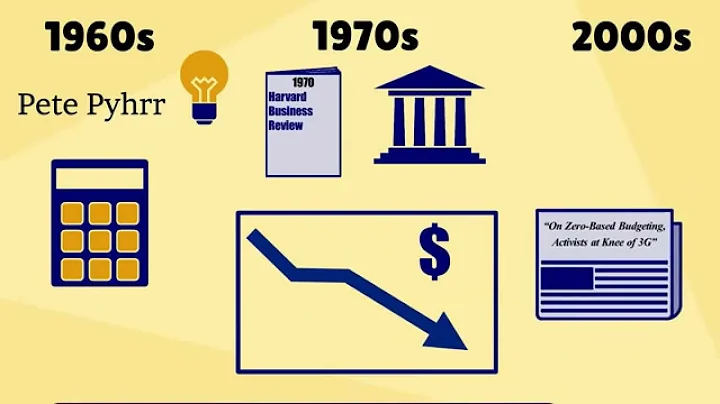

The original goal of ZBB was to help organizations reduce costs and promote fiscal responsibility. With zero-based budgeting, the budget is started from scratch or a “zero base” each year.

The zero-based budget is the best method of budgeting because: The zero-based budget ensures that every dollar you make is assigned a specific purpose. Which of the following is not a record-keeping feature you could expect from your bank?

- 1 Track your income. The first step is to calculate how much money you have coming in every month. ...

- 2 List your expenses. ...

- 3 Categorize your expenses. ...

- 4 Balance your budget. ...

- 5 Review and adjust your budget. ...

- 6 Here's what else to consider.

Key Takeaways. "Pay yourself first" is a personal finance strategy of increased and consistent savings and investment while also promoting frugality. The goal is to make sure that enough income is first saved or invested before monthly expenses or discretionary purchases are made.

Zero-based budgeting is the polar opposite of the traditional method of budgeting. Traditional budgeting considers the previous budget's expenditures and asks for incremental increases over previous budgets.

Unlike traditional budgeting approaches, zero based budgeting can be very costly, as well as time-consuming and complicated, to implement.

The zero-based budgeting works on the principle that every year, the projected expenditure for each project or programme must start from zero. It means all budget requests should be considered freshly for every year with a cost-benefit analysis.

What is a zero-based approach?

A zero-based approach seeks to link organizational designs to strategic priorities (for example, areas for investment compared with efficiency optimization) instead of a “one-size-fits-all” solution across the business.

Zero-based budgeting is also resource-intensive. It takes a lot more time and effort to closely review and justify every budget element rather than modify an existing budget and review only new elements. Some critics argue that the benefits of zero-based budgeting don't justify its time cost because of this.

- Though you can implement repeatable processes with ZBB, it will most likely be more time-consuming than traditional budgeting.

- You're also faced with getting other departments to cooperate, and they might not be able to adequately measure their needs for the entire year.

For example, let's say you're using zero based budgeting for your monthly expenses. You begin by listing all your sources of income, then allocate funds to different categories such as rent, groceries, utilities, and entertainment. This method encourages intentional spending and helps you maximize your money.

The three types of annual Government budgets based on estimates are Surplus Budget, Balanced Budget, and Deficit Budget. When the revenues are equal to or greater than the expenses, then it is called a balanced budget. You can read about the Highlights of the Union Budget 2021-22 for UPSC in the given link.